Employment Allowance In First Year Of Trading

Is the trading allowance actually allowable against the second business income. You can not only earn 1000 under the trading income allowance before you start paying tax but you are also entitled to a personal allowance every tax year.

Download Form P87 For Claiming Uniform Tax Rebate Dns Accountants Tax Refund Tax Rebates

If youre self-employed you can get up to 1000 each tax year as a tax-free allowance.

Employment allowance in first year of trading. When an individual starts self employment in my case in 20102011 year can I claim first year allowances on the plant equipment that he introduces in to the business ie computervan tools. Se income of 20000 and expenses of 10000 OK. The trading allowance is a tax exemption of up to 1000 a year for individuals with trading income from.

If a loss is made within the first 4 tax years of trading after applying the opening year rules then the loss can be relieved against total income of the individual for the previous 3 tax years on a FIFO basis. If Amber purchases a car with higher CO2 emissions so above 110gkm which costs 8000 then the capital allowances would not be eligible for First Year Allowances instead it would fall under the special rate pool and receive capital allowances. The trading allowance has been introduced for the 201718 tax year onwards to exempt trading casual andor miscellaneous income of up to 1000 per tax year from income tax.

The loss cannot be restricted to save personal allowances. His Net profit for year end 050414 is 6244 so well below the tax free allowance limit but expected to be much higher next year. On the second one income of 10000 and trading allowance of 1000 has been offset.

This is called the Trading Allowance. So if the profit for the 12 months to 31 December 2018 is 12000 the overlap profit is 96365 12000 3156 over 96 days. The trading allowance is an allowance of 1000 thats available to some sole traders.

This might include income from what is often known as the sharing economy for example car sharing or perhaps against income. The allowance can only be claimed during the first year of the. If you use up your full 4000 Employment Allowance before the end of the tax year you must pay any remaining employer secondary Class 1 NICs liability to HMRC.

Casual services for example babysitting or. Tax allowance that permits British corporations to claim on eligible plan or machinery purchases. I have a new client who has 10500 of capital expenses in the first year of trading.

The Employment Allowance scheme was first introduced in April 2014 and allows eligible employers to reduce their Employers NI bill. Any company who employs staff including directors must pay Class 1 Employers NI at 138 on salaries above the. If you claim the trading income allowance in calculating.

The allowance can be used against any trading casual or miscellaneous income. If your business splits during the tax year and creates new businesses there will be no entitlement to the Employment Allowance in that tax year for any of the new businesses. As of 6th April 2017 if youre a sole trader with income from your business of under 1000 a year then you dont have to register for Self Assessment with HMRC or pay tax on your business income.

This is the amount you can earn before paying tax and is currently 12500 for 20202021. The First Year Allowance means that the full cost 15000 of the low CO2 car can be claimed as a capital allowance on Ambers 202122 Self Assessment tax return. In one of them they have 2 self-employments.

I had thought that the income from trades are combined together meaning that it wouldnt be claimable against the second trade. A new client has asked us to review the last 2 years tax returns. You can claim Employment Allowance if youre a business or charity including community amateur sports clubs and your employers Class 1 National Insurance liabilities were less than 100000 in.

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

The Employment Allowance 2019 20

The Trading Allowance How To Do Away With Receipts Taxscouts

The Fear Side Of The Greed And Fear Cycle Musing On The Markets Investment Strategies Analysis Intelligence For Seasoned Inv Finance Marketing Investing

Excelsior Trading Corporation Ltd Etcl Job Circular 2018 Bd Career Job Circular Job Trading Quotes

Https Www Kmu Admin Ch Dam Kmu En Dokumente Savoir Pratique Seco Mineurs Guide Pdf Download Pdf Seco Mineurs Guide En Pdf

Quiz How Much Do You Know About Limitations Of Micro And Macro Economics Limitations Of Micro And Macro Economi Micro Economics Economics Meaning Economics

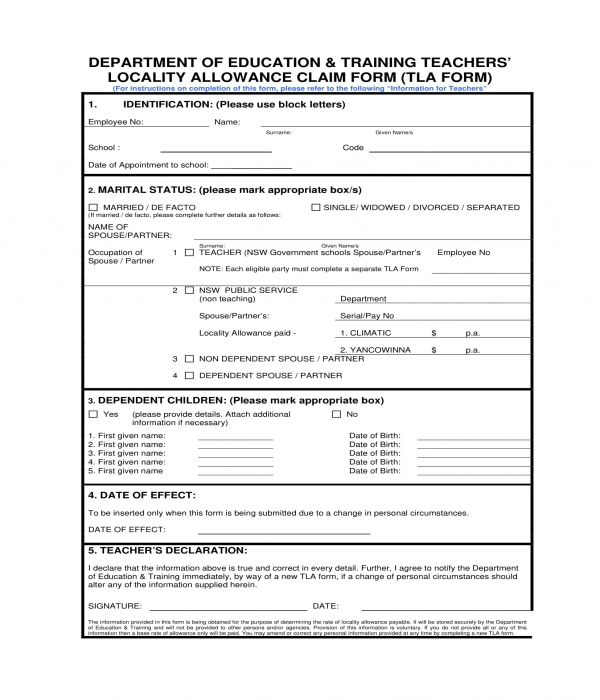

Free 32 Allowance Forms In Pdf Ms Word Excel

Sample Of Certificate Of Employment Fresh Sample Certification Employment Certificate Tu Simple Cover Letter Template Simple Cover Letter Cover Letter Template

10 Certificates Of Employment Samples Business Letter For Baby Dedication Certificate T Letter Templates Baby Dedication Certificate Business Letter Template

Sample Employee Contract Template Doc 23 Simple Contract Template And Easy Tips For Your Simpler Life Simple Contract Contract Template Contract Templates

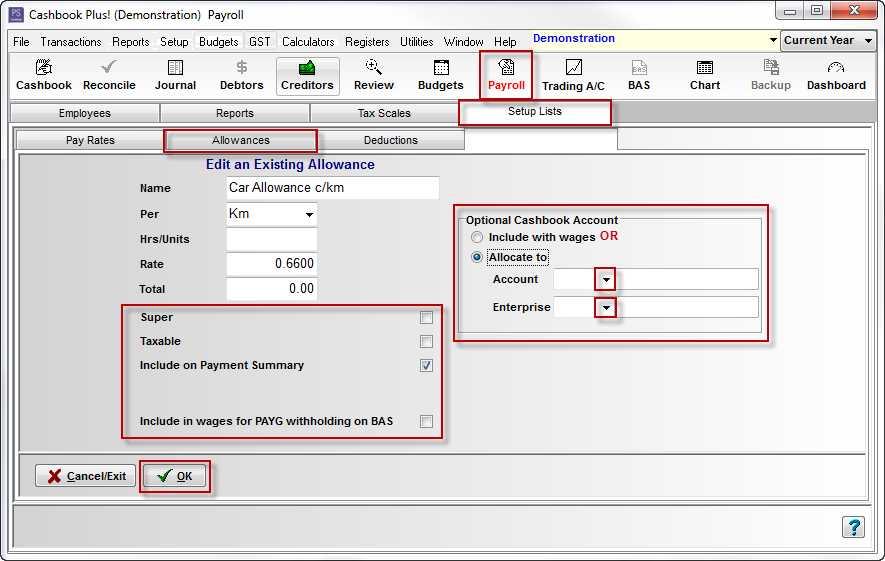

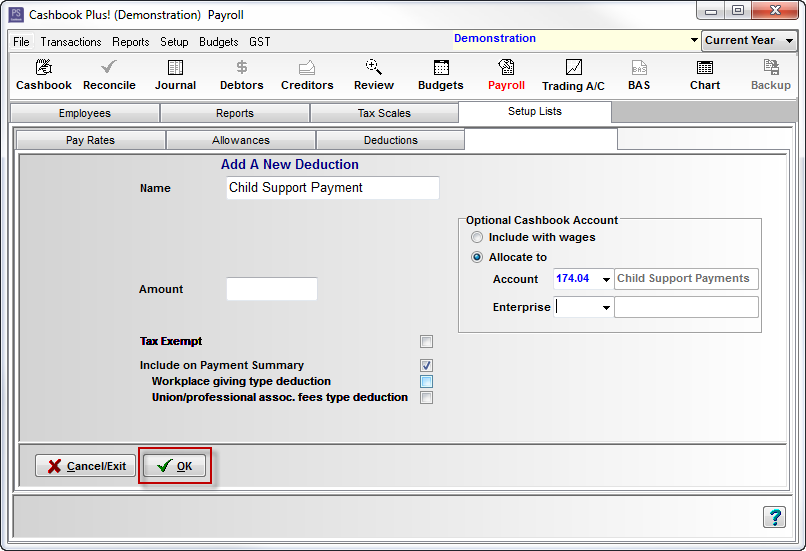

Payroll Allowances And Deductions In Wages Salaries Ps Support

Payroll Allowances And Deductions In Wages Salaries Ps Support

8 Tax Breaks For Small Businesses Tide Business

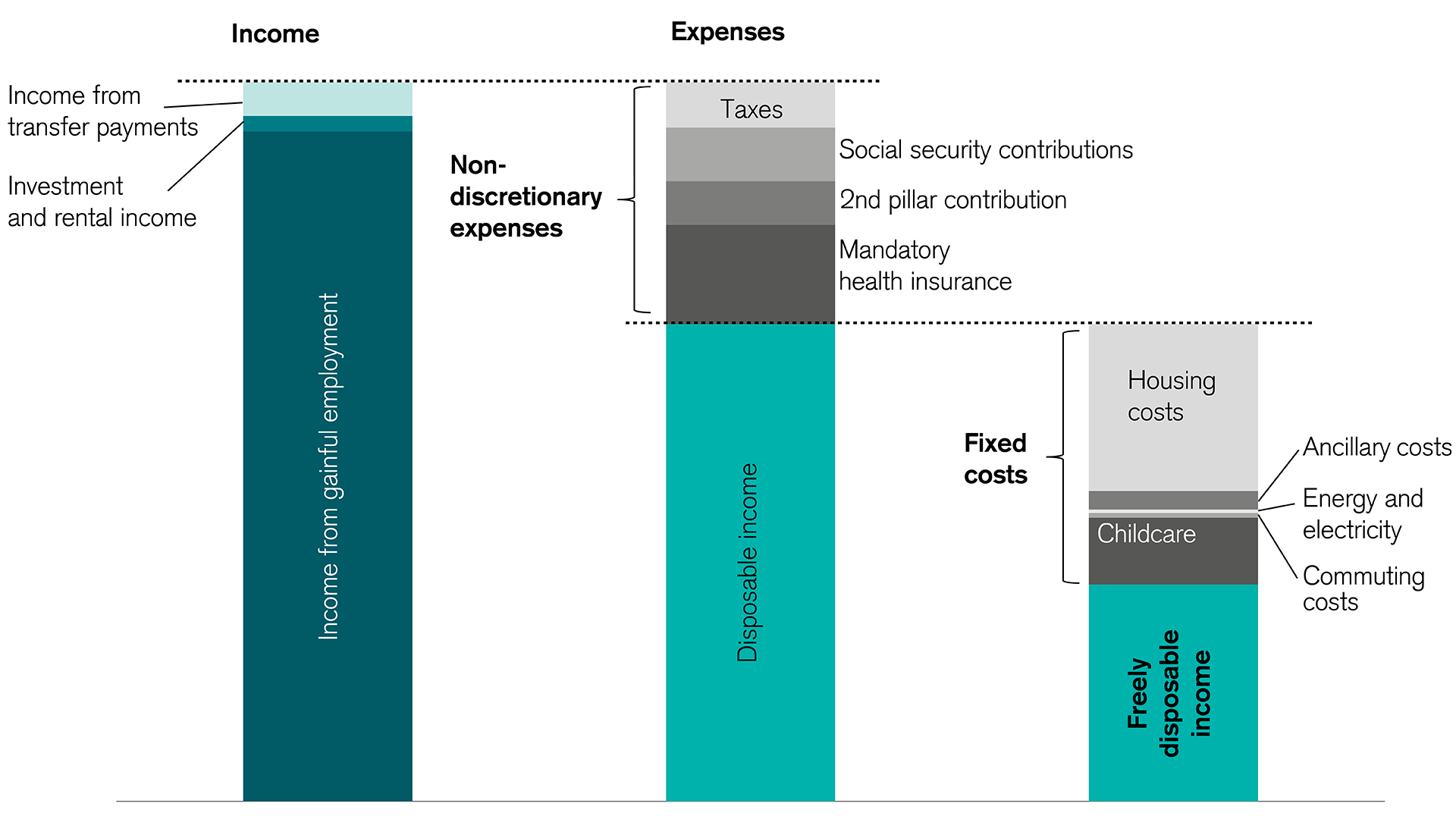

Disposable Income Where To Find Affordable Living In Switzerland Credit Suisse Switzerland

Post a Comment for "Employment Allowance In First Year Of Trading"