Employment Development Department State Of California Employee Withholding Allowance Certificate

Previously employees used the federal Form W-4 to claim exemption from both federal and state withholding. Number of allowances for Regular Withholding Allowances Worksheet A Number of allowances from the Estimated Deductions Worksheet B Total Number of Allowances A B when using the California Withholding Schedules for 2014 OR 2.

Should I Claim 1 Or 0 On My W4 What S Best For Your Tax Allowances Tax Brackets Allowance Form

Nonwage withholding nonresident withholding You may need to prepay tax if you receive a non-wage payment such as.

Employment development department state of california employee withholding allowance certificate. Address City State and ZIP Code. You must file the state form Employees Withholding Allowance Certificate DE 4 to determine the appropriate California Personal Income Tax PIT withholding. Additional amount of state income tax to be withheld each pay period if employer.

The Employment Development Department EDD offers no-fee seminars either classroom-style or online. Partnership and LLC distributions. Number of allowances from the Estimated Deductions Worksheet B Total Number of Allowances A B when using the California Withholding Schedules for 2016 OR 2.

15 deadline for employees. The classroom seminars are offered in a variety of locations throughout California. Employees Withholding Allowance Certificate Form W-4 from the Internal Revenue Service IRS will be used for federal income tax withholding only.

EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE 1. The EDD also offers online. Number of allowances for Regular Withholding Allowances Worksheet A Number of allowances from the Estimated Deductions Worksheet B Total Number of Allowances A B when using the California Withholding Schedules for 2010 OR 2.

EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE 1. Number of allowances for Regular Withholding Allowances Worksheet A Number of allowances from the Estimated Deductions Worksheet B Total Number of Allowances A B when using the California Withholding Schedules for 2019 OR 2. Additional amount of state income tax to be withheld each pay period if employer.

Only need to adjust your state withholding allowance go to the Employment Development Department EDD website and get Form DE 4 Employees Withholding Allowance Certificate. The purpose of the California State Withholding Certificate is to establish employees desired withholding for California State Income Tax. If you do not provide your employer with a withholding certificate.

New employees and other employees making withholding changes must fill out the federal Form W-4 and Californias Form DE 4 Employees Withholding Allowance Certificate the department said on its website. The updated Form DE 4 Employees Withholding Allowance Certificate may be used to claim exemption from California withholding. EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE 1.

The number of allowances claimed on your Employees Withholding Allowance Certificate IRS Form W-4 or EDD Form DE 4 submitted to your employer. Previously an employer could mandate use of state Form DE 4 only when employees wished to use additional allowances for estimated deductions to reduce the amount of wages subject to state. California employees are now required to submit both a federal Form W-4 Employees Withholding Certificate and state Form DE 4 Employees Withholding Allowance Certificate when beginning new employment or changing their state withholding allowances.

Number of allowances for Regular Withholding Allowances Worksheet A Number of allowances from the Estimated Deductions Worksheet B Total Number of Allowances A B when using the California Withholding Schedules for 2018 OR 2. EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE. Need to withhold less money from your paycheck for taxes increase the number of allowances you claim.

Access COVID-19 Resources Apply for Unemployment. New California employees and those making changes to their withholding must fill out the state withholding certificate starting in 2020 the states Employment Development Department said Jan. EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE 1.

First Middle Last Name Social Security Number. Our Response to COVID-19. EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE Complete this form so that your employer can withhold the correct California state income tax from your paycheck.

Number of allowances for Regular Withholding Allowances Worksheet A. Additional amount of state income tax to be withheld each pay period if employer. The state retained the Feb.

Additional amount of state income tax to be withheld each pay period if employer agrees Worksheet C. EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE 1. EDD program benefits are available to workers and employers whose earnings are impacted.

Number of allowances for Regular Withholding Allowances Worksheet A Number of allowances from the Estimated Deductions Worksheet B Total Number of Allowances A B when using the California Withholding Schedules for 2005 OR 2. Additional amount of state income tax to be withheld each pay period if employer. Filing Status SINGLE or MARRIED with two or more incomes MARRIED one income HEAD OF HOUSEHOLD.

EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE 1. California State Employees Withholding Certificate Instructions Purpose. They are customized to help educate both existing and established employers as well as new employers to better understand and comply with the state payroll tax laws.

Number of allowances for Regular Withholding Allowances Worksheet A Number of allowances from the Estimated Deductions Worksheet B Total Number of Allowances A B when using the California Withholding Schedules for 2012 OR 2. Your payer must take 7 from your CA. The form itself is very similar to the Federal W-4 with one exception the form is completely voluntary.

The sudden and immense impact of the COVID-19 pandemic is unprecedented. 27 by the states Employment Development Department. Additional amount of state income tax to be withheld each pay period if employer.

The 2020 version of Californias withholding certificate was released Jan. Additional amount of state income tax to be withheld each pay period if employer.

How To Fill Out Form W 4 Tax Forms The Motley Fool Signs Youre In Love

Https Www Edd Ca Gov Pdf Pub Ctr De1275ws Pdf

Https Edd Ca Gov About Edd Pdf News 21 15 Pdf

Https Www Edd Ca Gov Pdf Pub Ctr De1326t Pdf

Https Www Edd Ca Gov Pdf Pub Ctr De678i Pdf

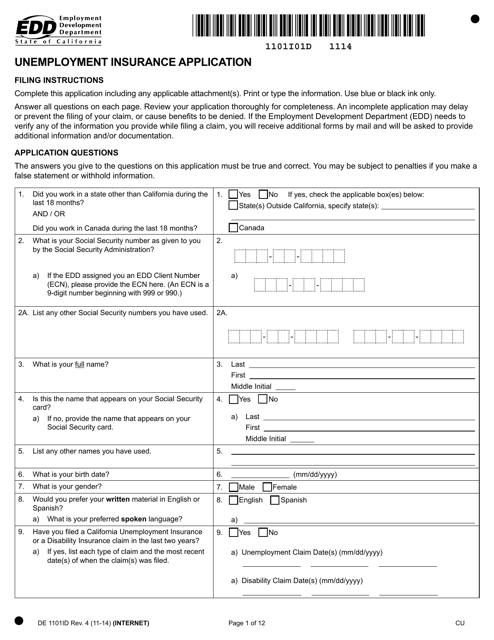

Form De1101id Download Fillable Pdf Or Fill Online Unemployment Insurance Application California Templateroller

Https Www Svusd Org Uploaded Do Web Team Forms De 4 Rev 47 12 18 Fill In Pdf

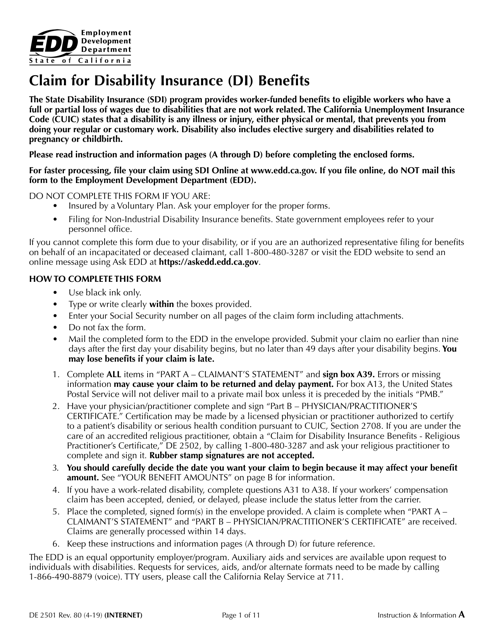

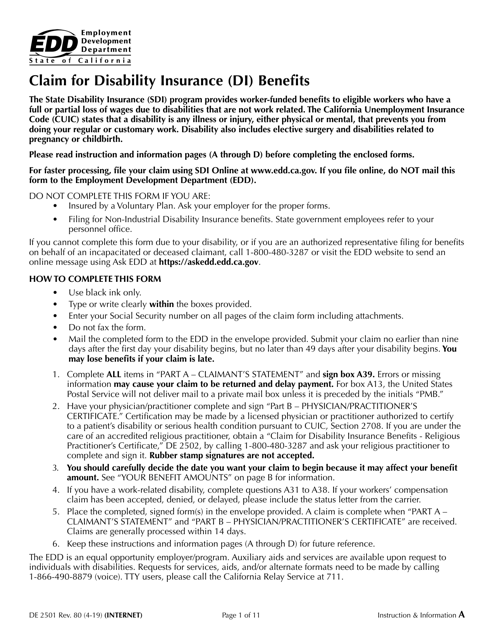

Form De2501 Download Printable Pdf Or Fill Online Claim For Disability Insurance Di Benefits California Templateroller

Fillable Form De 678 Fillable Forms Income Tax Social Security

Https Www Edd Ca Gov Pdf Pub Ctr De231y Pdf

Https Www Edd Ca Gov Pdf Pub Ctr De2220r Pdf

Https Www Edd Ca Gov Pdf Pub Ctr De1i Pdf

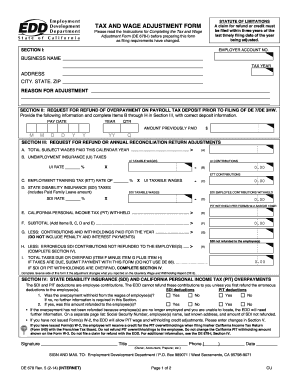

Https Edd Ca Gov Pdf Pub Ctr De9adji Pdf

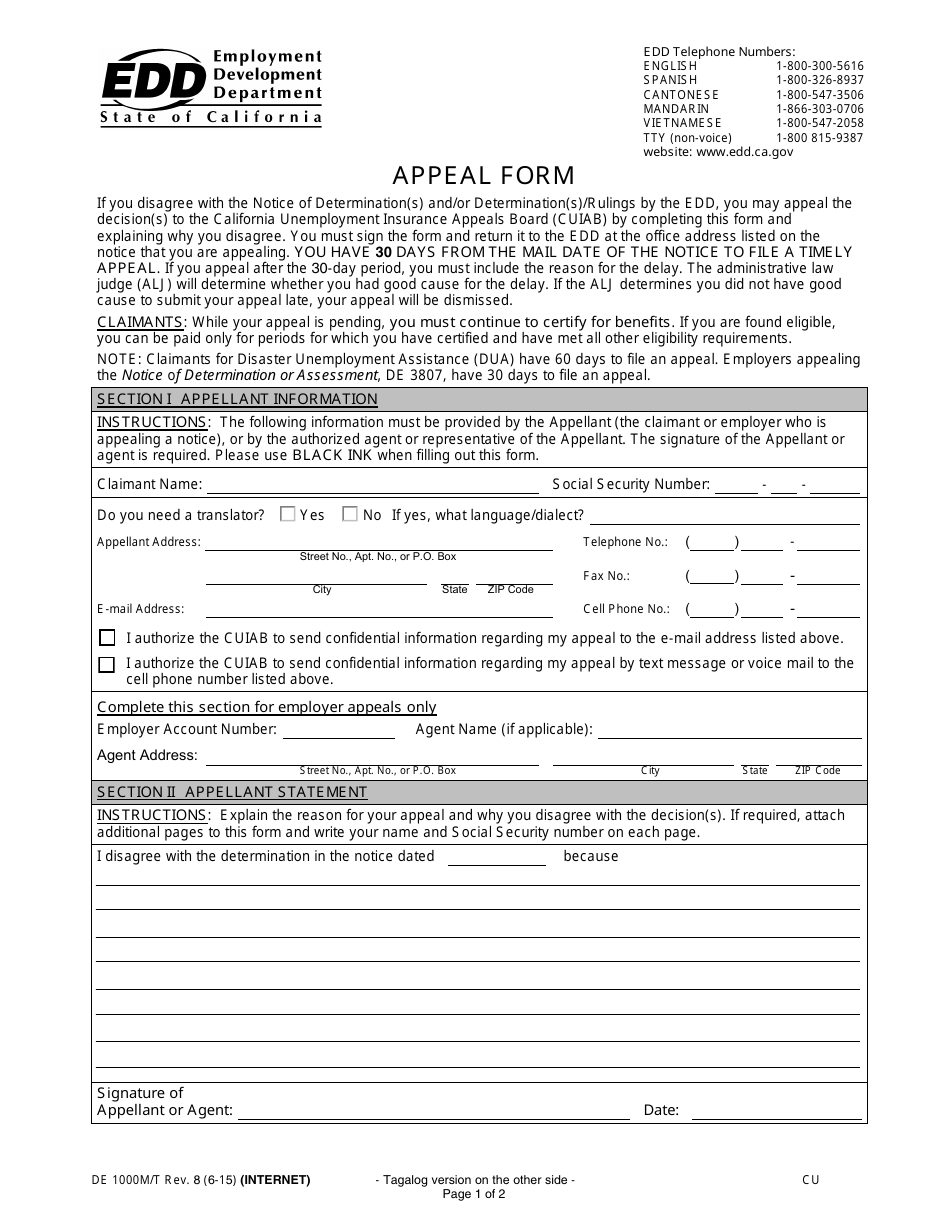

Form De1000m T Download Fillable Pdf Or Fill Online Appeal Form California Templateroller

Https Www Edd Ca Gov Pdf Pub Ctr De231r Pdf

Https Www Edd Ca Gov Pdf Pub Ctr De938 Pdf

Sample Form De429z Download Printable Pdf Or Fill Online Notice Of Unemployment Insurance Award California Templateroller

Post a Comment for "Employment Development Department State Of California Employee Withholding Allowance Certificate"