Self Employment First Grant Criteria

Intends to continue to trade in the tax year 202021. You need to be self-employed or a member of a partnership.

Have You Correctly Claimed The Third Self Employment Income Support Scheme Seiss Grant Low Incomes Tax Reform Group

The first grant covered the period from.

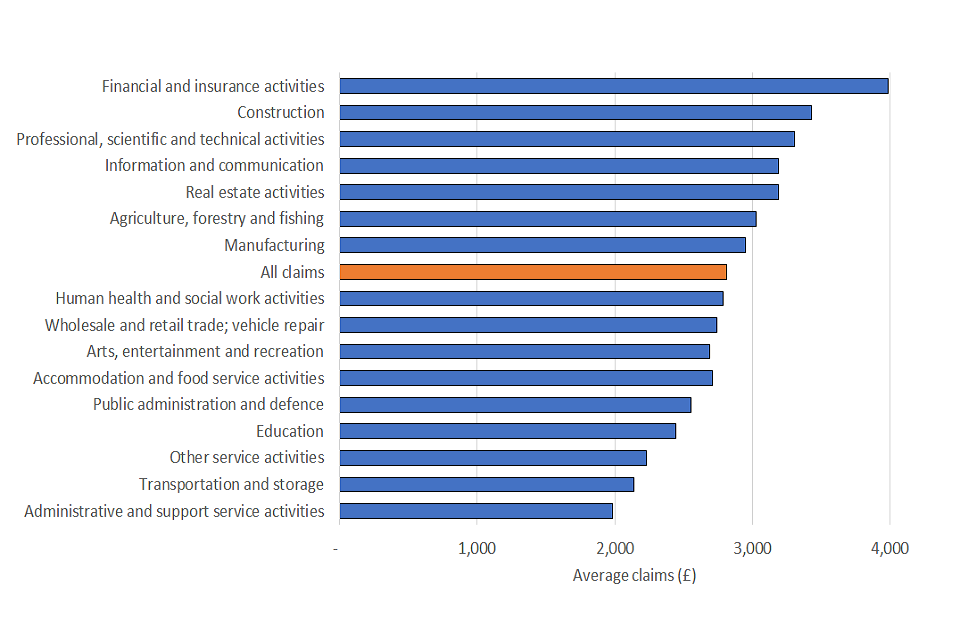

Self employment first grant criteria. Be currently trading but are impacted by reduced demand due to coronavirus. This will be a taxable grant worth 70 previously 80 of their average monthly trading profit for three months paid out as a single lump sum up to a maximum of 6570. There was a monthly maximum limit of 2500 and this first grant covered three months.

If youre eligible and want to claim the first grant you must make your claim on or before 13 July 2020. The first taxable grant was based on 80 of a self-employed persons average monthly profits over the last three years capped at 2500 per month. The Self-Employment Income Support Scheme has a fifth and final grant covering the period from May to September with applications opening to all by the end of first week of August.

The first grant was based on 80 of your average monthly profits from self-employment for the 201617 201718 and 201819 tax years. Traded in the tax year 201920. To be eligible for the extended scheme self employed individuals including members of partnerships must meet also the following criteria.

To be eligible for the grant you must be a self-employed individual or a member of a partnership. The eligibility criteria remain the same as for the first grant. First and second grants.

Resident in the UK and have chosen the remittance basis. To claim you must have believed you would have a significant reduction in profits for one of two reasons either because of reduced demand activity or capacity OR youre unable to trade. The lender said that it would accept applications from self-employed borrowers who had received an SEISS grant as long as it was not in the last three months.

However the eligibility criteria. 2019 to 2020 and submitted your tax return on or before 2 March 2021. To claim you have to fulfil all of these.

The Self-Employed Income Support Scheme the scheme is open to those who have annual profits of less than 50000 and receive at least half their income from self-employment. Currently be eligible for the SEISS although they do not have to have claimed the previous grants. Claims for the first SEISS grant which opened on 13 May must be made no later than 13 July.

You may be eligible for the grant if youre self-employed and are either. If youre not eligible based on your 2019 to 2020 Self Assessment tax return we. There are four grants available under the Self-Employment Income Support Scheme the first grant covers the period March to May 2020 the second covers the period June to August 2020.

This reduced to 70 for the second grant payable in August. SELF-employed grants under the Self-Employment Income Support Scheme SEISS can provide people with essential support during this tough period. Submitted their 201819 self assessment tax return by 23 April 2020.

Where the conditions outlined below are met eligible individuals can apply for a grant payment under a total four rounds of the scheme. Eligible self-employed individuals or partners whose trade continues to be or is newly adversely affected by Coronavirus may be able to claim a second and final SEISS grant some time from August. Self-employed individuals and members of a partnership are eligible where the taxpayer.

HMRC look at your trading profits and non-trading income on your Self Assessment tax returns to check if you meet the eligibility criteria for the fifth grant. As a reminder this is a taxable grant of 80 of an average monthly trading profits paid out in a single instalment covering 3 months worth of profits and capped at 7500 in total. Carries on a trade which has been adversely affected by coronavirus.

In an update to its criteria it added that brokers will no longer need to complete a mandatory self-employed application submission sheet and the self-employed triage team will not have to complete an affordability check. We also use your average trading. Eligible self-employed people must make a claim before that date to receive the first SEISS grant.

Not resident in the UK. The SEISS grant rules are simple - the first grant is for those whose business was impacted by Covid-19 before 13 July and the second which comes in. A second and final grant will be available when the scheme opens again in August 2020.

The grant is subject to both income tax and Class 4 National Insurance contributions in the 202021 tax year. You need to have lost trading. Your trading profits must be no more than 50000 and at least equal to or more than your non-trading income.

You must have traded in the tax years. Your self-employed trading profits must be no more than 50000 and at least equal to your non-trading income.

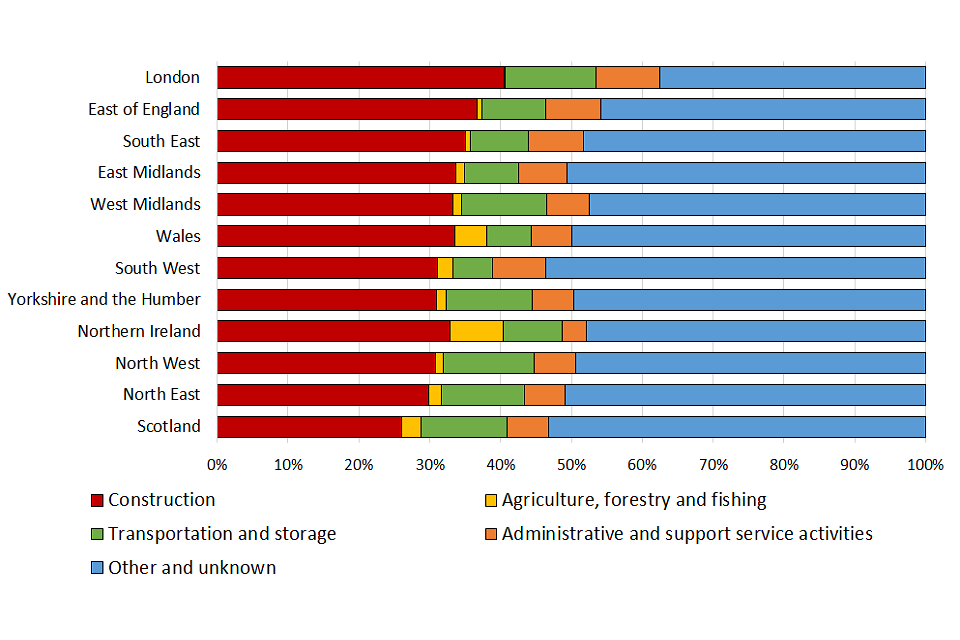

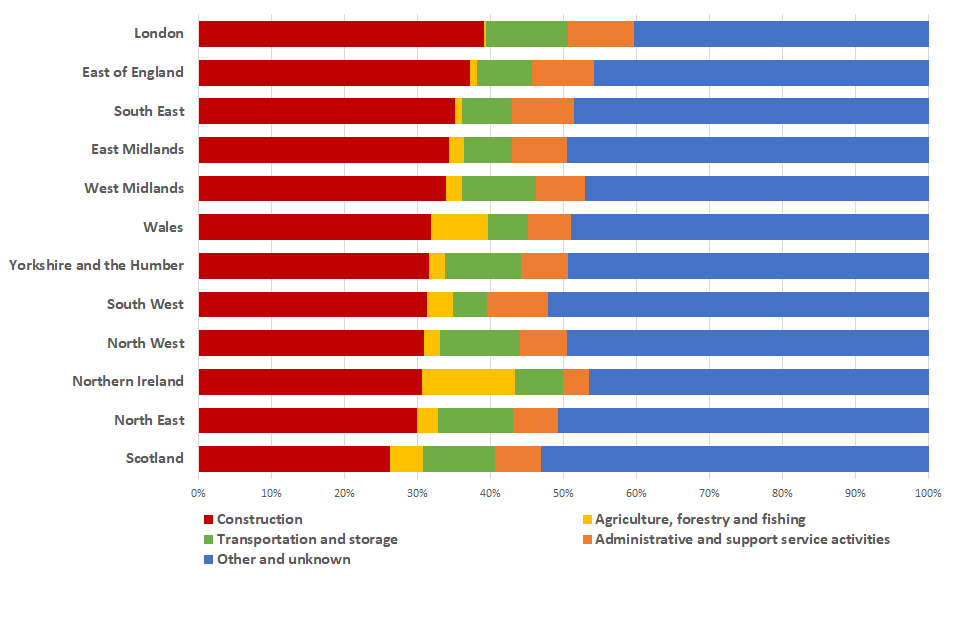

Self Employment Income Support Scheme Statistics January 2021 Gov Uk

Self Employment Income Support Scheme Statistics July 2020 Gov Uk

Seiss 5th Grant When And How Can I Claim It Mcl

Self Employment Income Support Scheme Statistics January 2021 Gov Uk

Seiss 5th Grant When And How Can I Claim It Mcl

Covid 19 Recovery Grant Ministry Of Social And Family Development

How To Claim 4th Self Employment Grant The Seiss Payment Explained And When The Hmrc Deadline To Apply Is

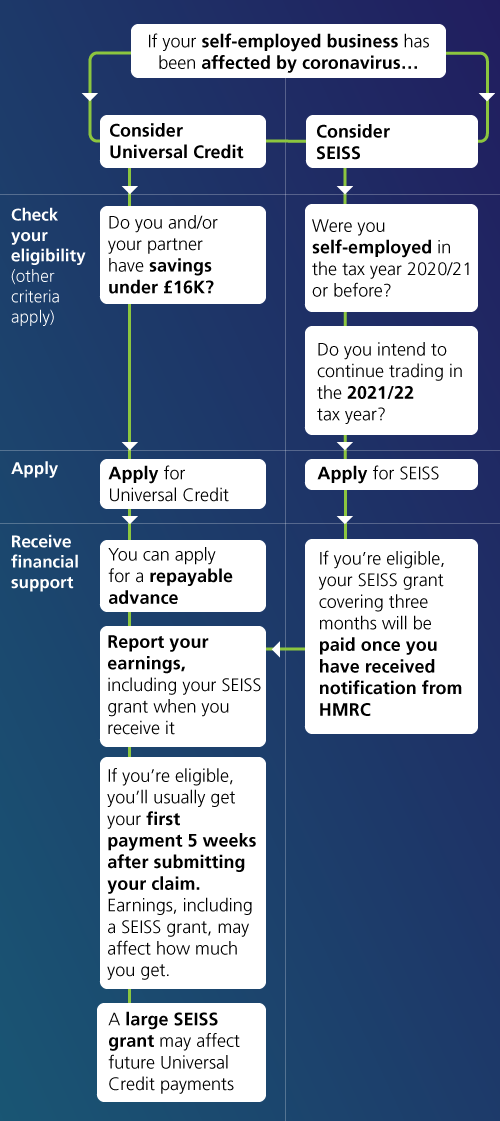

Self Employment Understanding Universal Credit

Https Www Hdb Gov Sg Residential Buying A Flat Resale Financing Cpf Housing Grants Single Singapore Citizen Scheme

Coronavirus Seiss Fourth Grant Low Incomes Tax Reform Group

Coronavirus Help For The Self Employed Explained Which News

When Is The 4th Self Employed Grant How To Claim The Seiss Payment And Who Can Apply

Self Employment Understanding Universal Credit

Fourth Self Employed Grant Seiss Payment Confirmed In Budget Date Hmrc Claims Could Open And Who Is Eligible The Scotsman

Can I Claim A Self Employed Grant How Much Will I Get And When Will It End

Self Employment Understanding Universal Credit

Coronavirus Seiss Fifth Grant Low Incomes Tax Reform Group

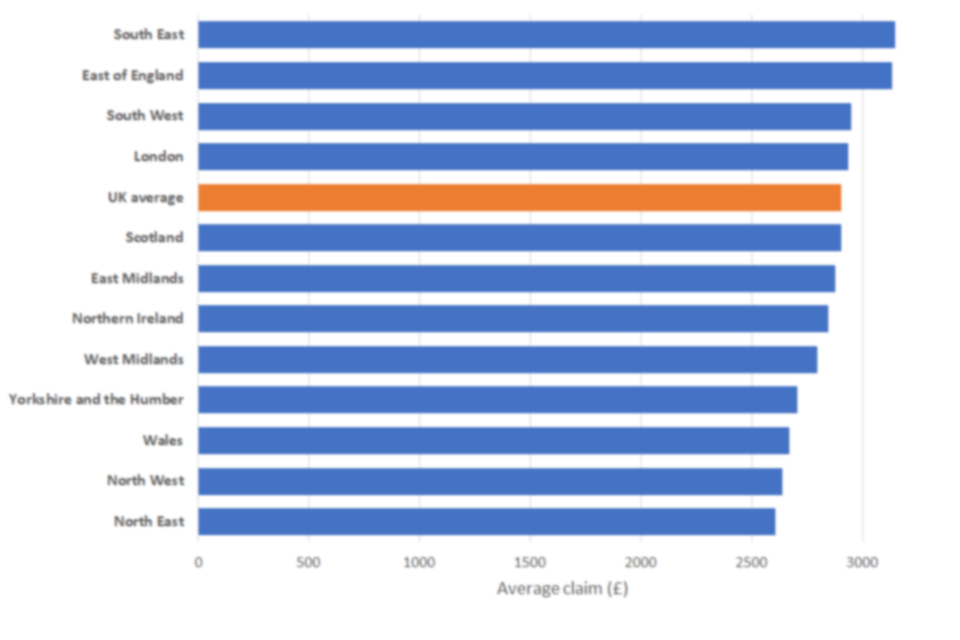

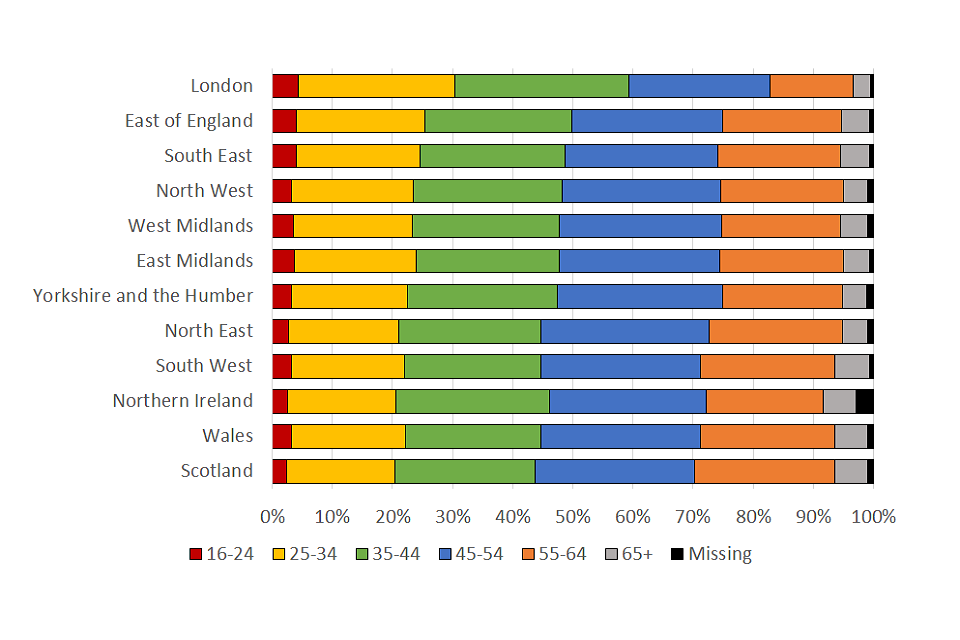

Self Employment Income Support Scheme Statistics July 2020 Gov Uk

Self Employment Income Support Scheme Statistics January 2021 Gov Uk

Post a Comment for "Self Employment First Grant Criteria"