Self Employment First Grant Dates

To claim the first grant the trade must have been adversely affected by COVID-19 in the period up to and including 13 July 2020. The one notable variation was in the timing of when a trade has to be adversely affected.

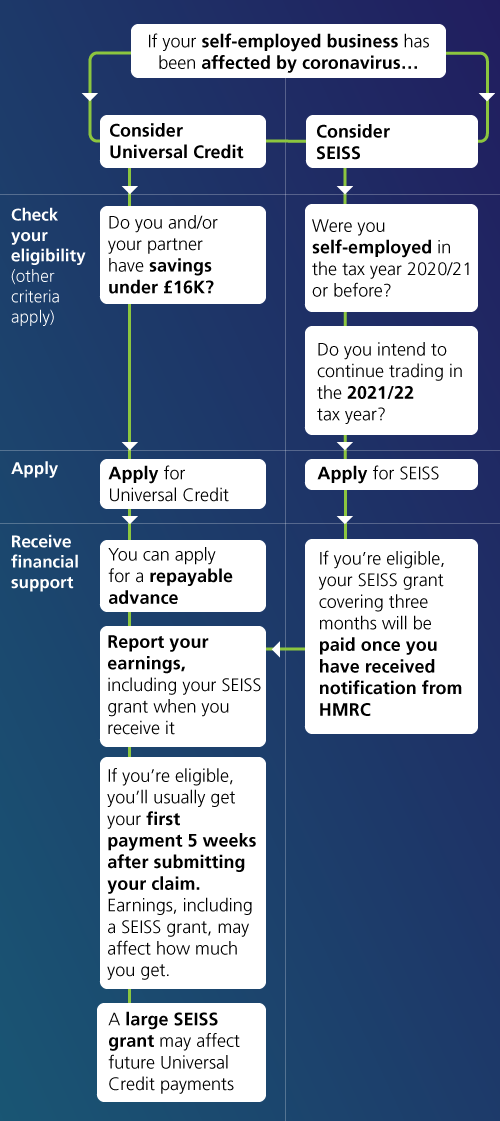

Self Employment Understanding Universal Credit

As of midnight on 24 May 2020 23 million claims had been made worth a total of 68 billion.

Self employment first grant dates. Impact of the scheme so far. Eligibility criteria Self-employed individuals including members of partnerships are eligible if they. The 31 January during the tax year would be 31 January 2022 the 5 October following the end of the tax year would be 5 October 2022 and the 31 January following the end of the tax year would be 31 January 2023.

Steps to complete the Calculator. Step 1 read the notes and Government guidance above on eligibility for the scheme. Eligible business owners have until 13 July 2020 to claim their first grant.

There are four grants available under the Self-Employment Income Support Scheme the first grant covers the period March to May 2020 the second covers the period June to August 2020. Self-Employment Income Support Scheme Factsheet. The Chancellor recently announced that the Self-Employment Income Support Scheme SEISS will be extended with eligible individuals able to claim a second and final grant and HMRC has now confirmed that those eligible for the first grant must claim for it on or before 13 July 2020.

A second grant has also been introduced to help self-employed workers that struggle in June July and. Unlike earlier SEISS grants the grant would take into account 201920 tax returns and be open to those who became self-employed in tax year 201920. HMRC should make the grant payments in August 2020.

The first grant which is closing from July 13 covers lost profits from March April and May. The grant would cover the period February to April and applications would open from late April. To claim the second grant the trade must have been adversely affected on or after 14 July 2020.

Its now only for businesses affected by Covid-19 on or after July 14. The last date for making a claim for the third grant was 29 January 2021. So far applications have opened and closed for three grants under the.

Updated to confirm that the online service for the first grant is closed. Details about the fourth grant will be. If eligible HMRC will contact operators mid-April to provide a personal claim date and this will be when they can make the claim from.

Operators will be able to claim the fourth grant via the online claims service from late April until 31 May. The scheme was originally announced on 26 March 2020 and provided an initial grant for self-employed individuals whose businesses were adversely affected on or before 13 July 2020. Claims for the third grant have now closed.

The Government will give self-employed workers grants worth 80 per cent of total profits up to 2500 a month if theyve lost income due to coronavirus. The Self-Employment Income Support Scheme claim service is now open. The first grant billed as covering March to May 2020 was available to businesses adversely affected up to 13 July 2020.

A fifth and final grant would cover May to September. Continued to trade in 2019. Submitted their Income Tax Self-Assessment tax return for the tax year 2018-19.

A second grant was then made available for self-employed individuals whose businesses were adversely affected on or after 14 July 2020. Not all of the dates listed below may apply to you even if you are self-employed. Guidance will be announced on Friday June 19 for the second grant due to be paid in August.

Applications for the second grant will open in August and the eligibility criteria remain the s. The Government has approved four SEISS grants for eligible self-employed people during the coronavirus pandemic. The third will cover the period November 2020 to January 2021 and the fourth and final grant covers the period February 2021 to April 2021.

The first grant was 80 of the average monthly profits for three months subject to a maximum grant of 7500. The second grant billed as covering June to August 2020 was available to businesses affected on or after 14 July 2020. The grant is for three months making the maximum grant 6570.

The first grant will be paid in a single lump sum to cover three months worth of profits and is based on 80 of.

Fifth Self Employed Income Support Scheme Grant To Open For Claims In July Taxassist Accountants

Seiss Grant What Is Seiss And How Do I Apply

Coronavirus Help For The Self Employed Explained Which News

Coronavirus Seiss Fifth Grant Low Incomes Tax Reform Group

Coronavirus Help For The Self Employed Explained Which News

Seiss 5th Grant When And How Can I Claim It Mcl

Can I Claim A Self Employed Grant How Much Will I Get And When Will It End

Covid 19 Recovery Grant Ministry Of Social And Family Development

Covid 19 Recovery Grant Ministry Of Social And Family Development

Fourth Self Employed Grant Seiss Payment Confirmed In Budget Date Hmrc Claims Could Open And Who Is Eligible The Scotsman

Self Employment Understanding Universal Credit

Self Employment Understanding Universal Credit

Seiss 5th Grant When And How Can I Claim It Mcl

Seiss Grant 5 When Can I Claim 5th Hmrc Self Employed Grant Date Applications Open And Who Can Apply The Scotsman

How To Claim 4th Self Employment Grant The Seiss Payment Explained And When The Hmrc Deadline To Apply Is

Coronavirus Seiss Fourth Grant Low Incomes Tax Reform Group

The Cost Of Coronavirus The Institute For Government

Supporting Livelihoods During The Covid 19 Crisis Closing The Gaps In Safety Nets

Covid 19 Recovery Grant Ministry Of Social And Family Development

Post a Comment for "Self Employment First Grant Dates"